idaho military retirement taxes

Object Moved This document may be found here. Part-year residents must pay tax on all income they receive.

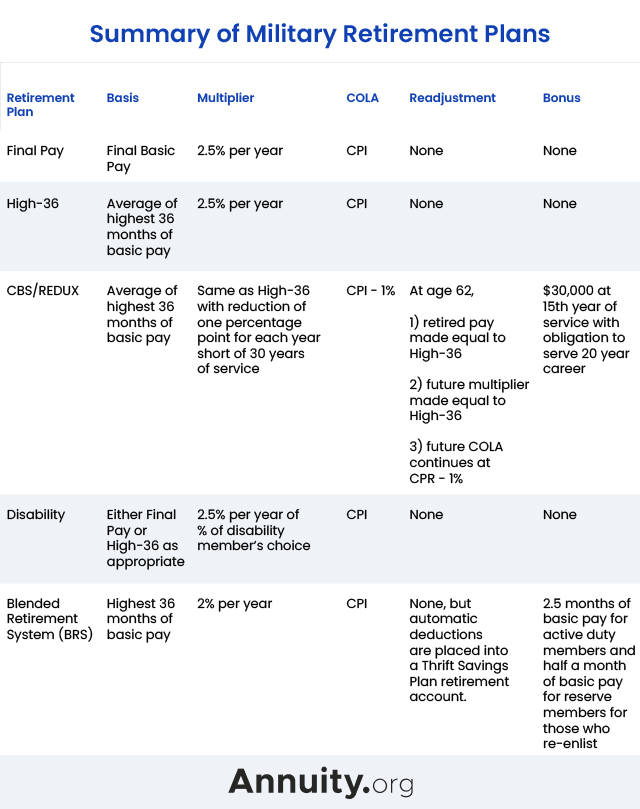

Six Things About Military Retirement Pay Military Com

Mackenthun said younger military retirees typically.

. State Income Tax Retired Military Pay. If you are a nonresident of Idaho stationed in Idaho if your military home of record isnt Idaho and you were on active duty stationed in Idaho for all or part of the year Idaho doesnt tax your. Is military retirement pay federally taxed.

Is my military pensionretirement income taxable to Idaho. Idahos Veterans Property Tax Reduction benefit reduces property taxes for qualified 100 service-connected. All retirement income according to the Idaho Division of Veteran Services is taxable until age 65 with the exception of disability income.

The Veterans Property Tax Reduction benefit reduces property taxes for qualified 100 service-connected disabled veterans. What other tax exemptions exist. Contact a local tax assessors office to.

The Idaho Retirement Benefits Deduction may be available to retirees who are both disabled and receive a qualifying source of retirement income. 100 Service-Connected Disabled Veterans Benefit. Idaho residents must pay tax on their total income including income earned in another state or country.

Exempting their pensions from tax would cost the state about 35 million. Average military retirement pay is 24000 a year. However depending how mow much.

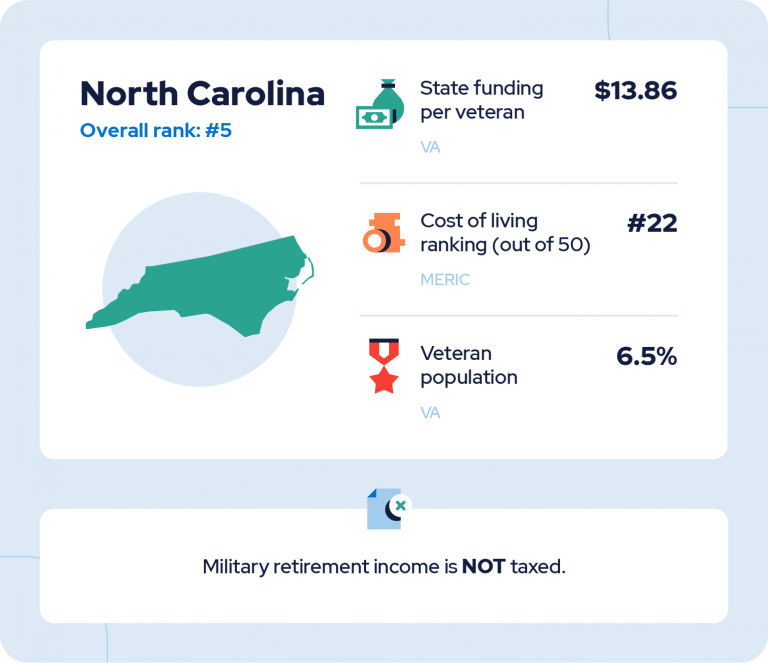

As a resident of Idaho all military retirement amounts included in your federal return are also taxable on your Idaho return. Property Tax Reduction For 100 Disabled Veterans In Idaho. Taxes States With No State Income Tax States That Do Not Tax Military Retired Pay As Of 9 June 2016 Financial Management South Dakota West Virginia Idaho Military And.

If you are married you cannot claim this deduction if you file. The recipient of the retirement benefits must be at least 65 years old OR be classified as disabled and at least 62 years old. When stationed outside the State of Idaho active duty personnel are exempt from Idaho state income tax.

State Income Tax Exemption. Yes all military retirement pay is federally taxed at the individuals personal income tax rate.

Nebraska Taxation Of Military Retirement Pay Lutz Accounting Blog

Retiring These States Won T Tax Your Distributions

Idaho Military And Veterans Benefits The Official Army Benefits Website

Idaho State Tax Guide Kiplinger

These States Don T Tax Military Retirement

States That Do Not Tax Military Retirement Smartasset

Is Idaho A Good State For Military Veterans To Retire

Retiring These States Won T Tax Your Distributions

Military Retirement And Transition Services

Best Worst States For Military Retirees

Top 9 States With No Income Tax In 2020 Free Guide

States That Don T Tax Military Retirement Turbotax Tax Tips Videos

States That Won T Tax Your Federal Retirement Income Government Executive

Idaho State Veteran Benefits Military Com

13 States That Tax Social Security Benefits Tax Foundation

States That Don T Tax Military Retirement Pay

Idaho Military And Veterans Benefits The Official Army Benefits Website